Car loan early settlement calculator

Experian Automotive said more than 86 of new car buyers take out a loan. What is the Early Settlement Charge in Car Loan.

Car Personal Loan Settlement Calculator

The premium is a one-time charge and the policy protects the lender.

. Can partial payment be made anytime in Car Loan. Make sure you dont lose on early repayment penalties by reading our guide. Early settlement of car loan.

An upside-down car loan means you have negative equity or owe more on the vehicle than it is worth. A 200000 mortgage payment with an interest rate of 4 on a 30-year fixed-rate loan is about 955 per month compared to the same loan with an interest rate of 3 which comes out to 843 per month. Credit Card Pay-off Calculator.

The comparison rate is based on a loan amount of. When will I receive my titlelien release. For regulated agreements this is normally an exit fee equal to around just 58 days interest charge.

Payroll unemployment government benefits and other direct deposit funds are available on effective date of settlement with provider. AED 1050 to AED 2620. With the car loan amount loan tenure and interest rate decided a monthly.

You can also see the total amount youll pay in interest fees and insurance. Our settlement figure calculator does not include any additional penalty charges that may be incurred. If the fact that youll probably have to pay a fee for paying off your car loan early hasnt turned you off of the idea then below are some tips on how you can settle your debt.

The Consumer Credit Early Settlement Regulations 2004 allow lenders to charge up to 58 days interest when you decide to repay your loan in full early. Personal loan repayments calculator. Early car loan settlement Yes it is possible to pay off your car loan earlier than the date originally agreed upon.

Partial payment can be made anytime. A full quotation will be provided when you apply and amounts may vary. Latest pay slip.

You could borrow 10000 over 48 months with 48 monthly repayments of 22504Representative 39 APR annual interest rate fixed 383. Typically deducting car loan interest is not allowed. However before you swagger into the bank.

Early settlement option Allowed on selected segments depending on the vehicle type. Please note if youve had your loan for more than 14 days the balance you see on Digital Banking is not the amount needed to pay off your loan in full the balance shown doesnt include any early settlement charges nor accrued but unapplied interest. Thats an increasingly common issue as more people take out longer car loans to buy vehicles.

100 of the adjusted amount. With an Orange Advantage home loan a non-refundable annual fee applies refer to the Orange Advantage Post-Settlement fees and charges located here for more information. Faysal Bank Car Loan Calculator - Faysal Bank Car Finance.

Contact your finance provider to get a settlement valuation - this will tell you how much you need to pay off to settle the plan. And 100 interest offset when linked to our Orange Everyday transaction account and you make a deposit into this account. This loan comes with no fees for extra repayments and no early exit fees.

1 of the outstanding amount. What is the charge of partial payment in Car Loan. AED 4000Kdepends on the nationality and type of loan Early Settlement Fees.

Cash loan car loan student loan or mortgage if you pay off your debt faster than required youll benefit from lower total interest charges and obviously spend less time in debt. The average new car loan is about 30000 for an average of 68 months. Debt Burden Ratio Calculator.

49 APR representative for loans between 75K and 25k for 1-5 years. I recently paid off my loan. 1 105 inclusive of VAT of remaining.

Use our car loan calculator to check out the right loan plans for you and your car before buying your new or used car. Depending on the types of car loan you choose either fixed or variable. You also can purchase owners title.

Keep in mind that an early settlement for your car loan will not drastically reduce the interest that you have to pay. Early settlement fee is 1 of finance amount Arrangement fee is 1 of loan amount Applicants can get up to AED 1000000 loan amount Documentation is simple and easy There is low salary requirement and long repayment period along with this scheme Credit Card Cheque book and debit card is provided free along with this scheme Applicants can. Copy of CNIC NICOP POC.

Please check with your employer or benefits provider as they. Repaying a loan early has pros cons. Each comes with its own set of terms per the Hire Purchase Act 1967.

The Car Loan calculation is designed to give you an indication and should be used as a guide only. Through equated monthly instalment EMI. If you pay back your loan before the end of your loan term we wont charge any fees.

The representative APR is the rate that at least 51 of people are expected to receive when taking out a loan within the stated amount and term range. 2 recent passport size photographs. Participate in the W-2 Early AccessSM program.

Work out what your loan will cost you each month. Youll receive a fixed rate between 699 pa. Before settling your student loans try getting back on.

But there is one exception to this rule. How Car Loan is repaid. You can also use loan calculators to check the rates according to the price of the car down payment interest rate and salary.

How is the. The example in the Car Loan calculator is not a quotation and it is for illustrative purposes only. If youre nearing the end of the loan term make sure that its worth making the early repayment and consider the interest youll pay.

Ways to pay off your loan sooner. Comparison rate based on your risk profile. 18 and UK resident only.

Your vehicle title will be released in 210 business days based on your method of payment for payoff and any applicable state law. First of all you need to know how much your monthly and annual income is because this is one of the most basic eligibility requirements. You need at least RM2000 gross monthly salary for a car loan in Malaysia.

An early settlement figure is the amount still owed plus interest and charges if you want to pay off your car finance early. In many cases student loan settlement should be a last resort particularly since defaulting on your loans will damage your credit score. The quickest way to view your interest is to use the mobile app.

Our car loan can help you spread the cost of a car purchase. When you take out a mortgage one of your closing costs will be for title insurance. 200 of the settled amount.

How To Write A Car Loan Settlement Letter United Settlement

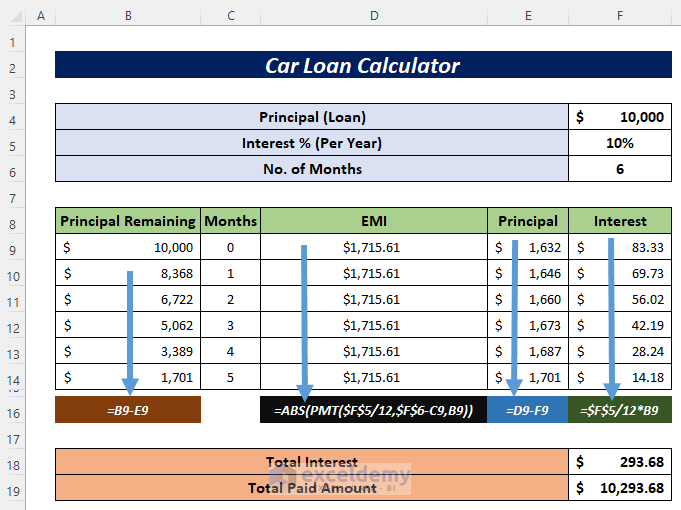

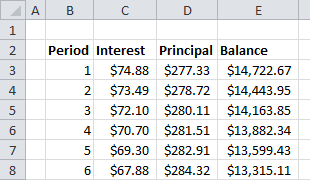

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

10 Free Household Budget Spreadsheets Debt Snowball Spreadsheet Debt Snowball Calculator Debt Reduction

Loan Repayment Calculator

Pin By Farmington Mortgage A Divisio On Home Loan Infographics Process Infographic Home Loans Debt Relief Programs

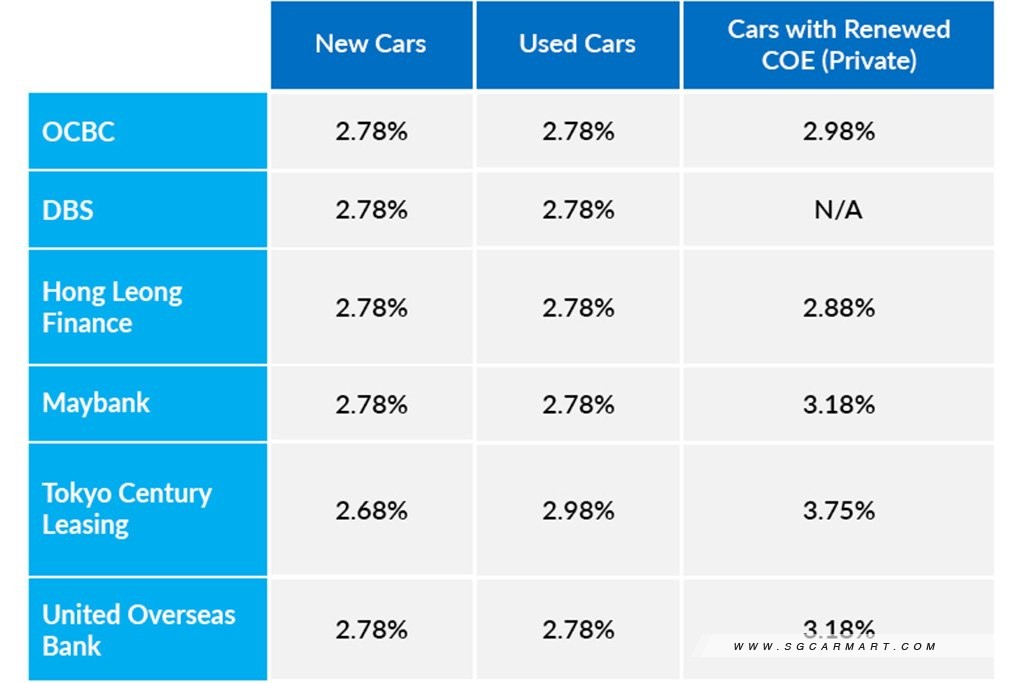

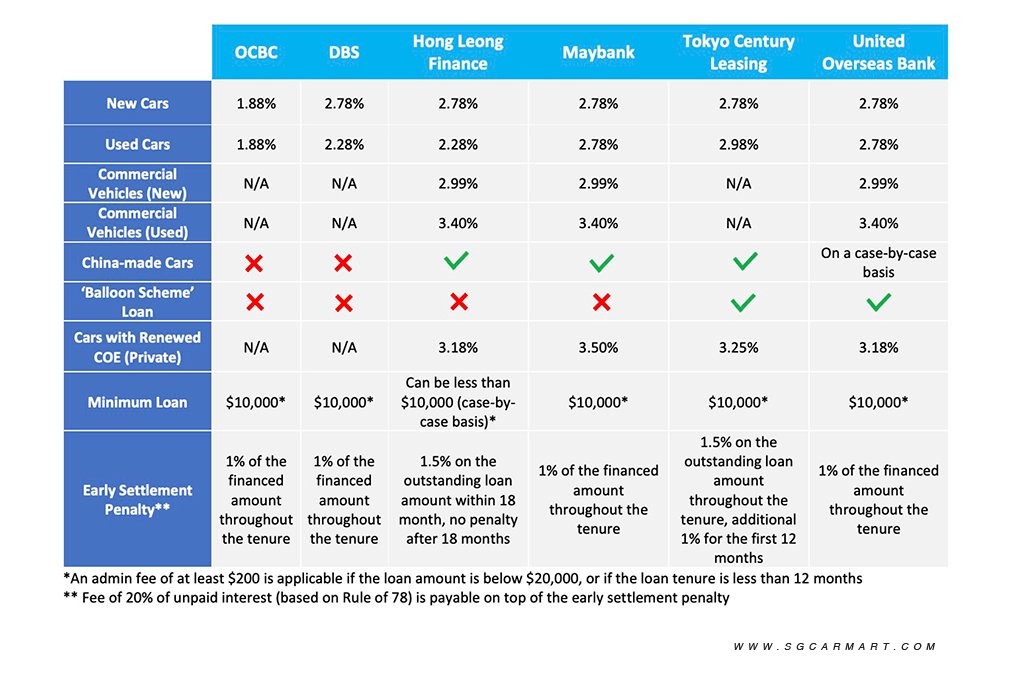

Car Loans Interest Rates And Terms Of Popular Banks And Finance Companies

Car Loan Calculator In Excel Sheet Download Free Template

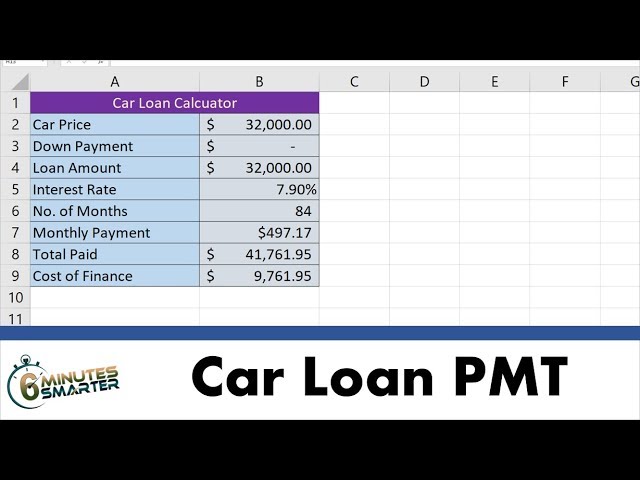

Create A Car Loan Calculator In Excel Using The Sumif Function Part 2

Sample Letter Creditor Settlement Offer Credit Repair Letters Credit Repair Credit Repair Companies

Printable Sample Loan Document Form Mortgage Payoff Payoff Letter Construction Loans

Car Personal Loan Settlement Calculator

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Pin On Car News

Home Car Loans

Car Loans Interest Rates And Terms Of Popular Banks And Finance Companies

How To Get A Car Loan With Bad Credit Forbes Advisor